To find and you will Guaranteeing an automible With no Borrowing

So, we need to buy a motor vehicle but i have zero credit score? You aren’t alone. In the twenty-six mil Americans are believed «borrowing from the bank undetectable,» if you find yourself various other 19 billion keeps credit files that will be very thin or dated they have been noticed «unscoreable.»

If you are in just one of such credit categories, your car financing choice are pretty slim. For many people, these are the options avaiable:

- Spend less and you will Shell out Dollars

- Get a good ‘Subprime’ Car loan

- Rating Preapproved

- Experience a car dealership

Despite you have ordered the auto, it may be an issue to acquire car insurance versus an effective decent credit history. Find out about simple tips to pick an automible and find the best car insurance cost without borrowing.

Save money and you will Pay Dollars

If you possess the some time patience, an informed bundle is to waiting and conserve up until you could spend dollars towards auto. Whatsoever, the best vehicle rate of interest are 0%. When you have dollars, you can easily buy from an exclusive merchant , exactly who you’ll give you a far greater rates.

Obviously, wishing actually an alternative should you want to purchase a motor vehicle to operate a vehicle to get results or college or university. If so, while don’t possess many in money on hand, you will need to loans.

Score an excellent ‘Subprime’ Auto loan

When you yourself have no credit score and require to find a good vehicles instantaneously, you’ll need to discover capital regarding subprime markets. Subprime no-credit people, considered by lenders is greater risk, regularly pay highest interest levels than just individuals who possess created credit histories.

This is because default prices is was basically as much as 8 percent from the subprime car field a year ago, and you can climbing. Expect to have a high downpayment requirements and you will interest rate than other borrowers. The average subprime debtor are paying mortgage over 16 %. If you are funding a mature automobile, otherwise one to with high distance, you will probably pay alot more.

Choosing the Auto. Generally, brand new earlier the car, the higher the latest advance payment that’s required. Subprime loan providers might require 20 percent so you’re able to 30 percent off. And you will banking companies and you may borrowing from the bank unions is reluctant to lend to the autos older than 10 years or above particular distance thresholds.

Tip: Pick a loan having no prepayment punishment. That way, as your borrowing from the bank improves, you will find a choice of refinancing the loan-which could possibly help you save hundreds of dollars 30 days.

Get Preapproved

Delivering preapproved getting an auto loan makes it possible to understand how far car you really can afford to find. Also, they advances their negotiating standing on the seller.

To acquire preapproved, make an appointment with your bank otherwise borrowing from the bank union’s branch otherwise borrowing from the bank director, thereby applying at its dining table. Brand new manager will be able to explain all solutions whenever you may have minimal or no credit history.

Should you choose get refused on financing, their banker might still be able to help from the form your up with an excellent «starter» mortgage, shielded charge card or any other borrowing-strengthening equipment. Forming a personal experience of the newest banker is also a benefit. For these reasons, it’s better to use in person, whether or not their bank otherwise borrowing from the bank relationship lets you use on the internet.

Exactly what You need

- A recent pay stub from your manager, ideally indicating seasons-to-time income

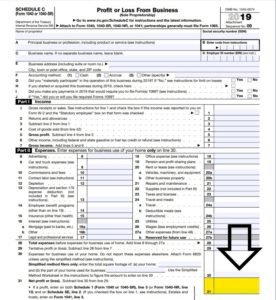

- Whenever you are mind-functioning or enjoys unusual earnings, offer around three months’ worth of lender comments

- Cellular telephone costs or other bills

- Recommendations off loan providers or companies

Tip: Extremely banks and borrowing unions favor money new automobiles and may wait to help you provide to have vehicles which might be over good very long time old. When you find yourself interested in a decreased-prices, put or high-usage vehicles, you have got alot more success that have a specialty automobile bank. You can also consult with your auto dealer’s funds service, which has actually relationships with many lenders.